Silver holds a long and varied history as a store of value and a way to express wealth in a compact form. Choosing between coins and bullion can feel like weighing apples and oranges when the shapes and markets differ.

Some buyers aim for metal weight and low cost per ounce while others prize legal tender status and designer faces. The decision often reflects personal goals, timing and a sense of how one likes to hold on to value.

Understanding Silver Coins Versus Bullion

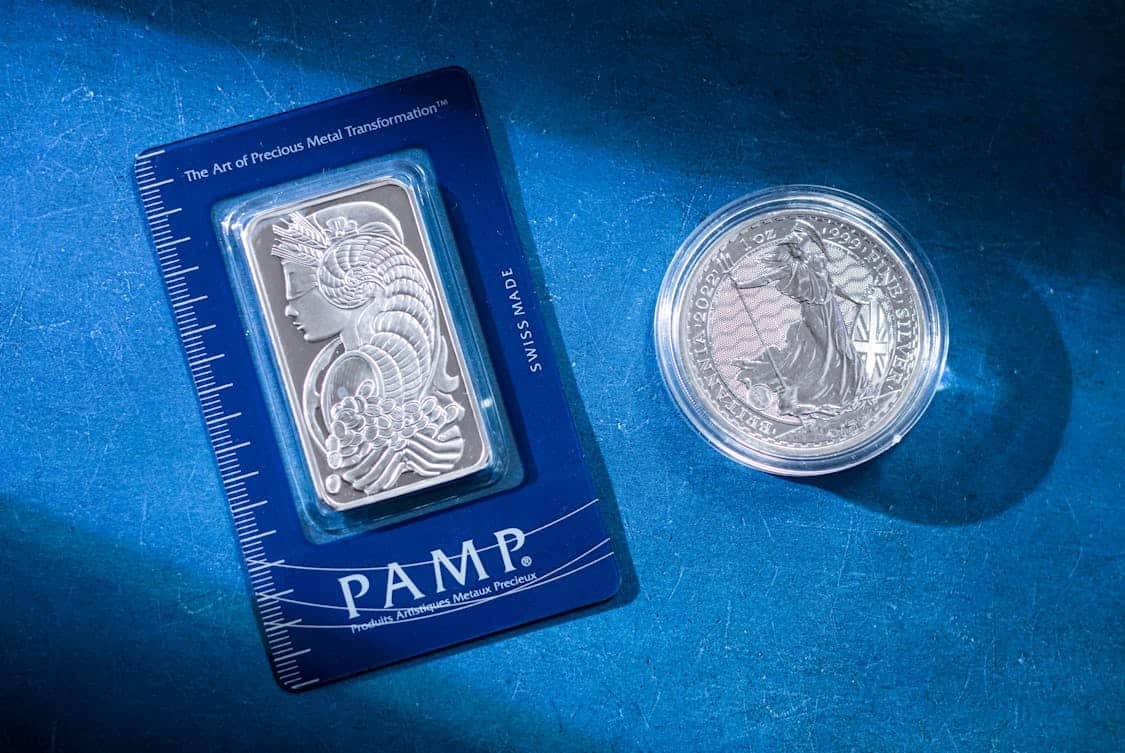

Silver coins are often struck with faces, dates and a declared legal tender value from a government mint. That status can give a coin extra appeal to collectors or to buyers who like the certainty of an official hallmark and consistent purity.

Bullion usually refers to bars or rounds that are valued mainly for weight and fineness and they carry fewer surface signs meant to attract attention. For many, the plainness of bullion is the very draw because it focuses attention on metal content rather than design.

Price behavior for coins and for bullion can diverge at times as the market values a coin’s rarity, condition and history in addition to its silver content. Premiums above the spot silver price are common for both items but tend to be higher for coins that enjoy collector demand.

If you want a clearer sense of whether a listed premium is justified, checking a reliable source that tracks the money metals exchange silver price can help you spot when a deal is fair or inflated.

A bar or a generic round typically trades close to spot because its value is tied tightly to an ounce count and a purity figure. That tighter link to metal weight gives some buyers a clearer line of sight to how much physical silver they actually own.

Liquidity And Marketability

How quickly an item converts to cash is a key question for anyone holding silver as an asset or as an insurance policy against uncertainty. Generic bars and rounds are widely accepted by dealers because their value is easy to verify through weight and assay marks.

Government issued coins often enjoy broad recognition too, which can speed a sale in many markets and sometimes in foreign places. The smallest coin denominations can be easier to sell in small amounts while very large bars might need a specific buyer willing to handle big pieces.

Local demand and the presence of reputable dealers shape how fast a coin or a bar will move without much fuss. In a thin market, a well known coin with a patent design may find a home quicker than an obscure round that would need extra testing.

Conversely, when the market is smoky, dealers often favor items they can resell quickly to their regular clients which can put generic silver in a favorable position. Sellers often learn that the right venue for a sale matters as much as the metal itself.

Premiums And Pricing

A premium is the amount paid above the spot market price of silver and it fluctuates with demand, minting costs and distribution. Coins that carry a collectible aura or that come with a government guarantee often command a larger premium per ounce than a plain bar does.

For budget conscious buyers who want pure metal exposure, stacking rounds or bars tends to stretch the purchasing power of a dollar. When a collector seeks a scarce year or a special strike, they accept paying extra for rarity and for an emotional or historical attachment.

Manufacturing scale and packaging also shape cost to the buyer. Small runs and elaborate artwork raise minting expense and that feeds into the sticker price.

Large produced bars that flow through established refinery networks benefit from reduced handling overhead which often keeps the extra charge modest. A savvy buyer watches the relationship between spot price and total cost and plans purchases during quieter stretches when premiums are more reasonable.

Storage And Security

Holding physical silver carries the same practical realities that any tangible asset brings along namely safe storage and the risk of theft or loss. Coins in capsules can be stacked in a home safe or in a deposit box and they are often small enough to hide in tight spaces.

Larger bars need flat surfaces and careful stacking to avoid damage but they are simple to audit visually and with a scale. Many investors weigh the convenience of handling small units against the need to guard and insure a collection.

Third party storage options exist and they provide vaulting, insurance and professional custody for a fee. A storage account for generic bullion often looks like an inventory list while an insured deposit for minted coins may require paperwork to record serial numbers and condition.

Fees and access terms vary so a person who values quick access might prefer keeping part of a holding within arm s reach. In contrast, someone comfortable with remote custody can benefit from a high security facility that treats metal as a form of monetary stock.

Collectibility And Emotional Value

A coin with a storied design or a limited release can spark a passion that goes beyond simple exposure to silver as a commodity. Collectors enjoy chasing patterns, mint marks and proof finishes that offer an aesthetic reward as well as a potential price uplift over time.

That pleasure can motivate a buyer to build a varied portfolio of coins that tell a historical tale or that reflect national art. Emotional value often helps holders stay the course during market swings since they own items that have meaning outside daily quotes.

Bullion buyers who prefer metal purity and cost efficiency might still develop an attachment to certain bar shapes, refiner marks or serial numbered pieces.

Even rounds with striking artwork can become favorites that friends enquire about at get togethers. Both camps report a feeling of satisfaction from tangibility which is hard to replicate in an electronic account. The human element plays a clear role when coins pass from one person to another as gifts or heirlooms.